current s&p 500 pe ratio,Google currents,current s&p 500 pe ratio,The tidal current flow for the average of the whole water column The tidal current flow for the surface layer which is the top 5% of the water column There’s a vast selection of properties for sale in Doha, from sleek apartments to luxurious .

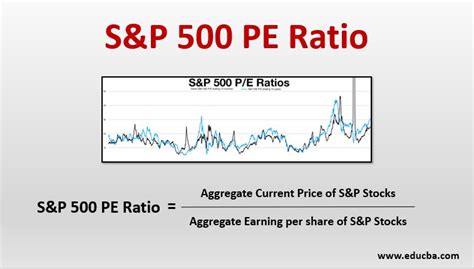

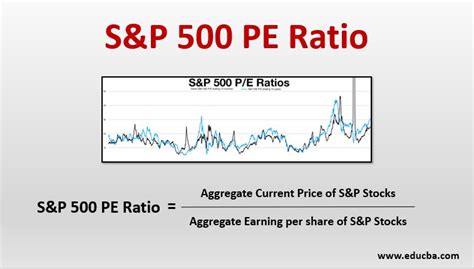

The Current S&P 500 PE Ratio serves as a critical metric in assessing the valuation and sentiment of the U.S. stock market. As of recent evaluations, the PE ratio has been a topic of keen interest among investors, analysts, and economists alike. This article delves into the significance of the S&P 500 PE ratio, its implications for investors, factors influencing its movement, historical context, and future outlook.

# Introduction

The S&P 500, comprising 500 of the largest publicly traded companies in the U.S., is widely used as a benchmark for the overall health of the stock market. The Price-to-Earnings (PE) ratio, a fundamental valuation metric, compares the current price of stocks in the index to their earnings per share (EPS). It provides insights into how much investors are willing to pay for each dollar of earnings generated by the companies.current s&p 500 pe ratio

# Importance of the S&P 500 PE Ratio

The PE ratio is a crucial indicator for investors as it helps gauge whether stocks are overvalued, undervalued, or fairly valued relative to historical norms and future earnings expectations. A high PE ratio may suggest that stocks are expensive relative to their earnings potential, while a low PE ratio may indicate potential undervaluation.

# Current S&P 500 PE Ratio Trends

As of the latest data, the S&P 500 PE ratio has been fluctuating within a certain range, influenced by various economic factors such as corporate earnings reports, interest rates, inflation expectations, and geopolitical developments. Understanding these trends requires a deeper analysis of recent market movements and their underlying drivers.

# Factors Influencing the PE Ratio

Several factors contribute to the movement of the S&P 500 PE ratio:

1. Earnings Growth: Strong corporate earnings growth tends to support higher PE ratios as investors anticipate future profitability.

2. Interest Rates: Changes in interest rates impact stock valuations; lower rates typically support higher PE ratios by reducing the discount rate applied to future earnings.

3. Inflation: Rising inflation expectations can lead to higher discount rates, potentially lowering PE ratios if earnings growth does not keep pace.

4. Market Sentiment: Investor sentiment plays a crucial role, influencing market valuations and PE ratios based on perceptions of risk and future economic prospects.

# Historical Context and Trends

Examining historical trends in the S&P 500 PE ratio provides perspective on market cycles, valuation extremes, and periods of market exuberance or pessimism. Comparisons with past market environments, such as the dot-com bubble or the financial crisis, offer lessons on the impact of valuation metrics on investor behavior and market outcomes.

# Current Economic Environment

In the current economic landscape, characterized by post-pandemic recovery efforts, supply chain disruptions, and shifting consumer behaviors, the S&P 500 PE ratio reflects broader economic uncertainties and recovery prospects. Analysts scrutinize economic indicators, corporate earnings reports, and Federal Reserve policies to gauge future market directions and potential impacts on stock valuations.

# Future Outlook

Looking ahead, the future trajectory of the S&P 500 PE ratio hinges on several key factors:

- Economic Recovery: Continued economic recovery and corporate earnings growth are essential for sustaining current market valuations.

- Monetary Policy: The Federal Reserve's stance on interest rates and inflation management will influence investor sentiment and market valuations.

- Geopolitical Developments: Global events and geopolitical tensions can introduce volatility and uncertainty, impacting investor confidence and market valuations.

# Conclusion

The Current S&P 500 PE Ratio remains a pivotal metric for investors navigating the complexities of the stock market. Its interpretation requires a holistic view of economic fundamentals, market dynamics, and investor sentiment. As market conditions evolve, ongoing analysis of the PE ratio alongside other valuation metrics will be crucial for informed investment decision-making and understanding broader market trends.

current s&p 500 pe ratio Versace Watch Online. Shop for Versace Watch in India Buy latest range of Versace Watch at Myntra Free Shipping COD Easy returns and exchanges

current s&p 500 pe ratio - Google currents